3 Simple Techniques For Paul B Insurance Medicare Insurance Program Huntington

Health insurance plan pay defines amounts for medical expenses or treatment as well as they can supply many options as well as differ in their strategies to protection. For assist with your specific concerns, you may want to talk with your employers advantages department, an independent professional consultant, or call MIDs Customer Solutions Division. Acquiring health and wellness insurance coverage is a very essential choice (paul b insurance medicare advantage plans huntington).

Lots of have a tendency to base their entire insurance policy acquiring decision on the costs quantity. As well as acquiring a great value, it is additionally essential that you take care of a firm that is solvent. There are a number of different type of medical insurance. Conventional insurance usually is called a"cost for solution "or"indemnity"plan. If you have standard insurance policy, the insurance provider pays the bills after you get the solution. Taken care of treatment plans use your regular monthly

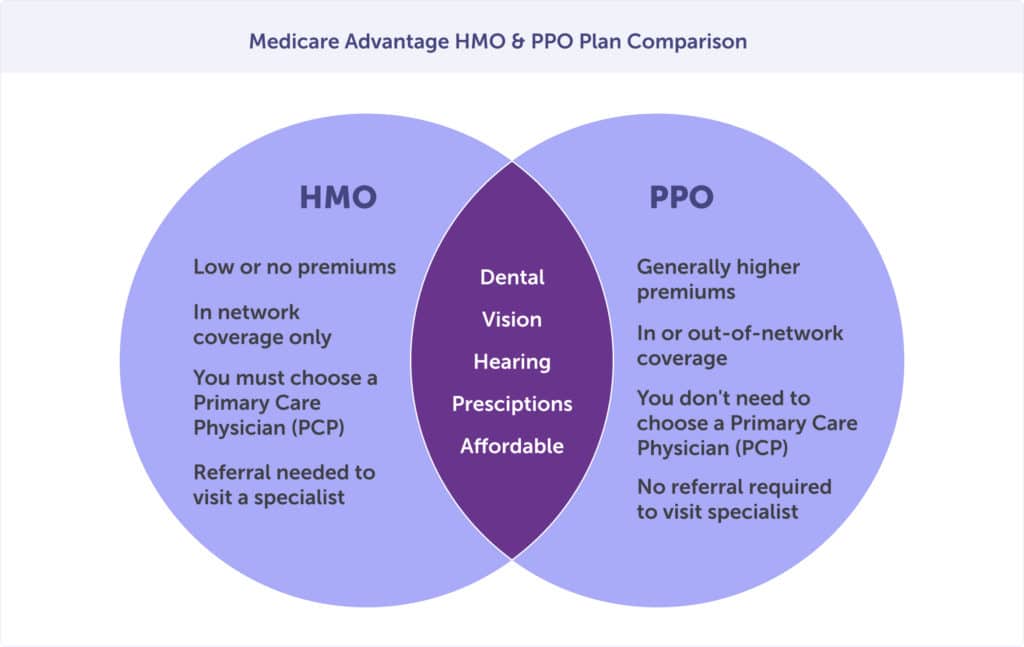

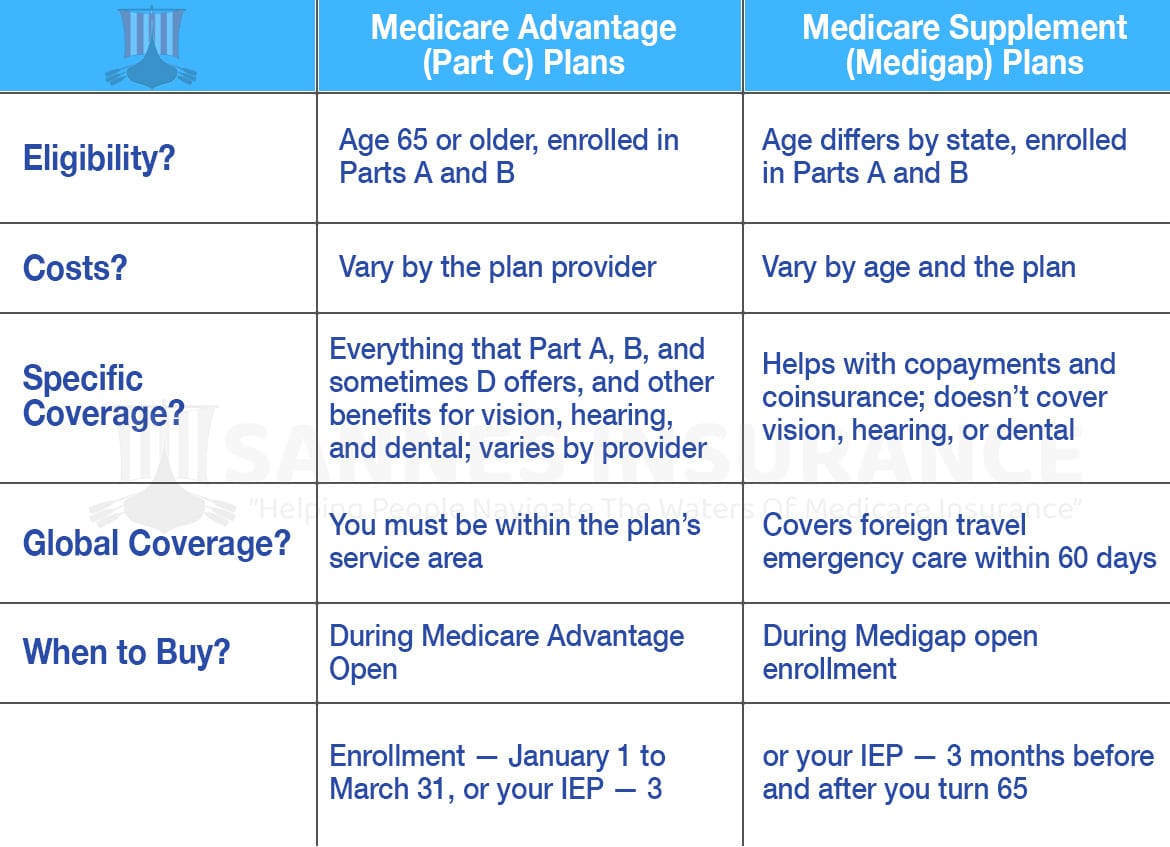

settlements to cover the majority of your clinical costs (paul b insurance medicare advantage plans huntington). Health Care Organizations(HMOs) and also Preferred Service Provider Organizations(PPOs )are the most usual took care of care organizations. Handled care strategies motivate as well as in some cases need consumers to make use of medical professionals and also medical facilities that belong to a network. In both standard insurance coverage and also managed treatment strategies, consumers may share the price of a service. This price sharing is.

frequently called a co-payment, co-insurance or deductible. Various terms are used in talking about wellness insurance coverage. "Suppliers"are physicians, healthcare facilities, pharmacies, labs, immediate treatment centers as well as other health care facilities and also specialists. Whether you are taking into consideration signing up in a standard insurance coverage plan or managed treatment strategy, you must recognize your

lawful civil liberties. Mississippi law needs all insurance firms to plainly and also truthfully disclose the complying with info in their insurance coverage: A complete listing of products and services that the healthcare strategy spends for. State laws restrict for how long preexisting problem exemption durations can be e&o for private and also group health insurance. If you have a group health insurance plan, a pre-existing problem is a great post to read wellness condition for which clinical recommendations, medical diagnosis, care or treatment was suggested or obtained within 6 months of signing up witha strategy. If you have a private strategy, a pre-existing problem is a wellness problem for which clinical recommendations, medical diagnosis, care or treatment was recommended or gotten within year of joining your plan. Your plan may refuse to spend for solutions related to your pre-existing condition for one year. You may not have to offer a pre-existing condition exclusion duration if you have the ability to get credit score for your health care insurance coverage you had prior to you joined your brand-new plan. Ask your strategy for more details. Your health and wellness insurer should restore your strategy if you wish to restore it. The insurance firm can not cancel your plan unless it pulls out of the top article Mississippi market completely, or you dedicate fraud or abuse or you do not pay your costs. All health and wellness treatment strategies need to have composed procedures for receiving and also settling problems. Complaint procedures have to be regular with state legislation requirements. If your health and wellness insurance company has actually refused to spend for wellness treatment services that you have received or desire to obtain, you have the right to know the precise legal, clinical or various other factor why. If you have a problem regarding a wellness insurance provider or a representative, please refer to our File a Complaint Page. Bear in mind that when you are contrasting business as well as asking for the number of issues that have been filed against a company, you should be aware that usually the firm with the most policies in force will certainly have a lot more problems than business that just have a few policies in area. Every managed care plan need to submit a description of its network of service providers and how it ensures the network can give health treatment solutions without unreasonable hold-up. In some cases, a doctor, hospital, or various other healthcare center leaves a managed treatment plans network. When this happens, a taken care of care plan need to inform you if you saw that supplier regularly.

Every took care of treatment strategy need to maintain close track of the top quality of the health and wellness care solutions it supplies. Every took care of treatment strategy ought to comply with certain treatments if it figures out that a health and wellness care service was not clinically required, reliable, effective or ideal.: that may not yet have a full time work that supplies health and wellness advantages must be conscious that in a growing number of states, solitary grown-up dependents may be able to continue to get health protection for a prolonged period( varying from 25 to 30 years old)under their parents 'wellness insurance plans also if they are no longer complete time pupils.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)